Check pan card details by pan no – enter your 10 digit pan number then click on submit button then show pan card holder details full…

Check pan card details by pan no

To check the details associated with a PAN (Permanent Account Number) card using the PAN number, you can follow the steps given below:

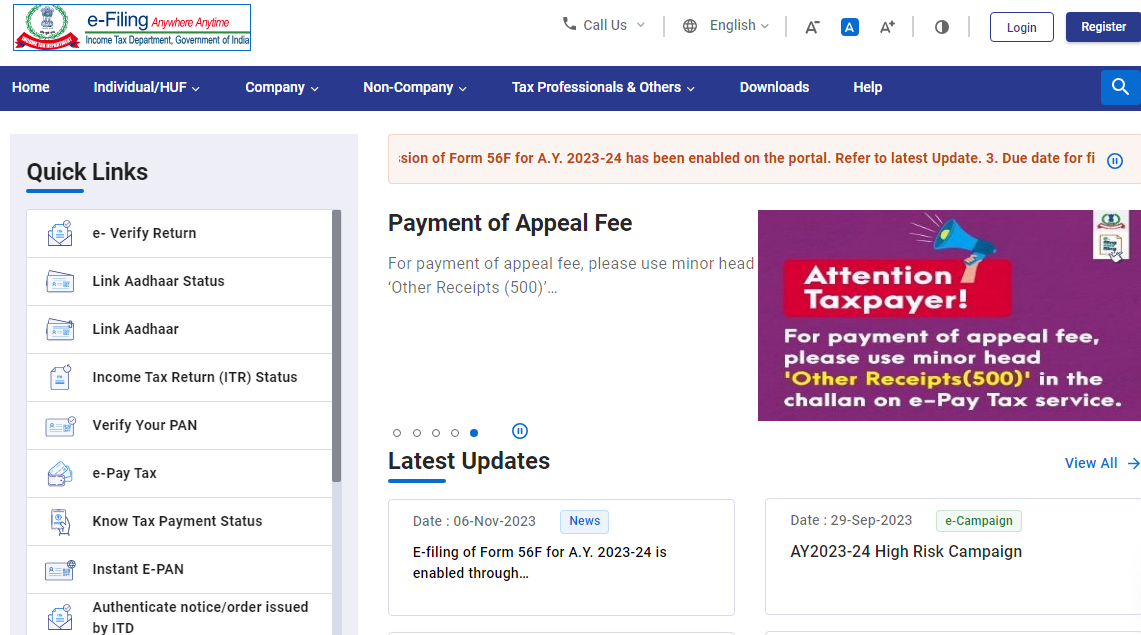

- Visit the official website of the Income Tax Department of India at https://www.incometax.gov.in/.

- Click on the “Verify Your PAN Details” link under the “Quick Links” section on the homepage.

- On the new page that opens up, enter the 10-digit PAN number in the “PAN” field.

- Fill in the other details, such as name, date of birth, and captcha code.

- Click on the “Submit” button.

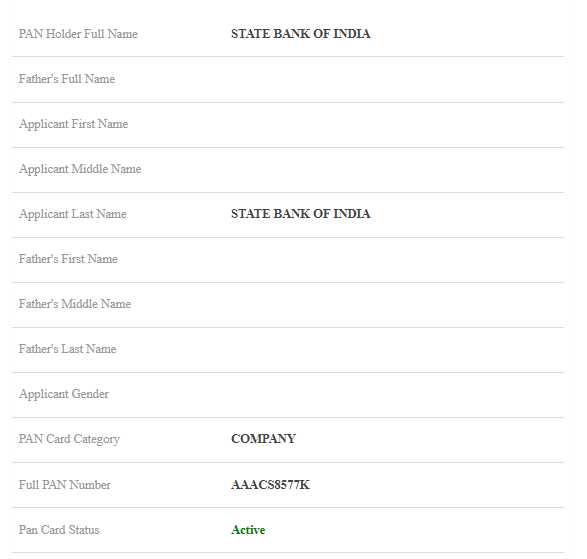

- If the details entered by you match the records of the Income Tax Department, you will be able to see the details associated with the PAN card, such as the name of the cardholder, the status of the PAN card, and other details.

Alternatively, you can also check the status of your PAN card application by visiting the NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited) website and entering your PAN number in the “Track PAN Card Application Status” section.

Pan card verify online by pan number

You can verify a PAN (Permanent Account Number) card online using the PAN number by following the steps given below:

- Visit the official website of the Income Tax Department of India at https://www.incometax.gov.in/.

- Click on the “Verify Your PAN Details” link under the “Quick Links” section on the homepage.

- On the new page that opens up, select the “PAN” option in the “Verify Your PAN” section.

- Enter the 10-digit PAN number in the “PAN” field.

- Fill in the other details, such as name, date of birth, and captcha code.

- Click on the “Submit” button.

- If the details entered by you match the records of the Income Tax Department, you will be able to see the details associated with the PAN card, such as the name of the cardholder, the status of the PAN card, and other details.

In case you want to verify the validity of a physical PAN card, you can also use the “Scan QR Code to Verify PAN” option on the same page. This option allows you to scan the QR code on the physical PAN card using a smartphone and verify the details associated with the PAN card.

Check pan card details by pan number

If you have 10 digit pan card number and you want to check pan card holder information then follow the steps given below

Step 1:- First of all you have to click on this link https://eportal.incometax.gov.in/iec/foservices/#/pre-login/verifyYourPAN

Step 2:- Then it will come in front of you to enter the PAN number. full name, date of birth, any mobile number.

Step 3:- all details fill after click on Continue Button.

Step 4:- Verify OTP, Then you will get to see the details of the PAN Card.

By entering the PAN card number like this, the name of the PAN card holder, his father’s name, PAN Card Category name, Applicant Gender

Name PAN Card Holder First Name, Middle Name, Last Name.

Know your Pan Card Issue Date

PAN Cards come with the date on which the document is issued and allotted to the applicant. This may not be imperative for a user who wants to perform a verification. However, it might still help to be aware of the date of issue of the PAN card. The users can see the PAN Card Issue date inscribed in a vertical position on the bottom-right corner of the document. The formatting will be DD / MM / YYYY without any spaces.

For instance, if the PAN Card issue date is 1st January 2022, the inscription will be shown as 01012022.

Know your PAN by Toll-Free Number

In efforts to make the customer service process better and more efficient, authorities have incorporated the toll-free feature for users to know your PAN Card. Cardholders can now simply call a toll-free number to enquire about their PAN card document. Check pan card details by pan no details below. This is free of charge, and customers can make their call anytime from anywhere.

- 1800 180 1961 for Income Tax Toll-Free Number

- NSDL Toll free number- 1800 222 990