An AO (Assessing Officer) code is used by the Indian Income Tax Department to identify the jurisdictional Assessing Officer for a taxpayer. However, for students who do not have any source of income, the AO code is not applicable as they are not required to file income tax returns.

When applying for a PAN card, a student who does not have any source of income can select the “Individual” category and choose the code “AOP (Association of Persons)” as the type of entity. They can also leave the AO code field blank as it is not mandatory for them to fill it. However, it’s always recommended to check with the NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited) website for the most updated guidelines and requirements.

As mentioned earlier, for students who do not have any source of income, the AO (Assessing Officer) code is not applicable as they are not required to file income tax returns.

You applying for a PAN card, a student who does not have any source of income can select the “Individual” category and choose the code “AOP (Association of Persons)” as the type of entity. They can also leave the AO code field blank as it is not mandatory for them to fill it.

Pan Card AO Code For Student ?

Never AO Code is for Student or non Student, if you are a student and you are making your PAN card then while making PAN card you can enter any part of your city in Area Code, AO Type, Range Code, AO Number. Also enter AO Code, because AO Code is not related to any type of income source,

if you do not have any source of income, then you can select No Income in the income source while filling the PAN card form. I repeat again that, first of all you have to select the AO Code nearest to your home address, and select No Income in the income source if you are a student.

AO code for no income individuals ?

If you are making a personal PAN card and you are looking for AO Code, then you should follow the steps given below carefully.

Step 1:- First of all, I want to clear your misconception, AO Code is never No Income, AO Number has nothing to do with Income.

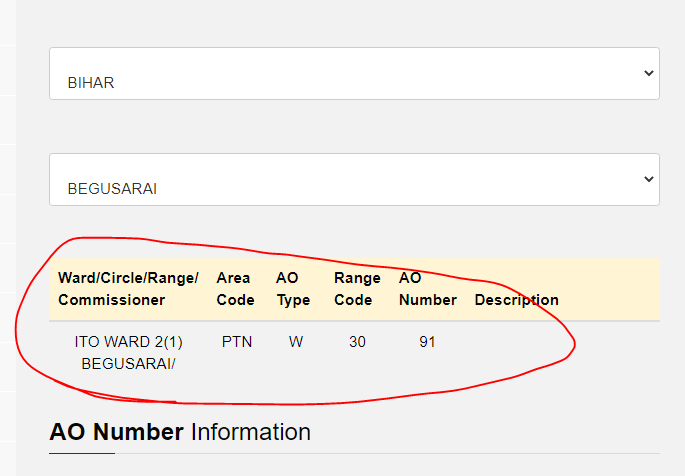

Step 2:- Click on this link https://aocodefind.go24.info/ to search AO Code / Number.

Step 3:- As you select the name of your state and city, the AO Code of that city automatically appears here, then from here you can see and fill in your new PAN card form.

Step 4:- If you have more than one AO Code, then which AO Number do you have to use, if you are from rural area then you should use AO Type – W, if you are from urban area then you should use AO Type – C.

For individuals who do not have any source of income, an AO (Assessing Officer) code is not applicable as they are not required to file income tax returns. However, when filling out a PAN (Permanent Account Number) card application form, they should select “Individual” as the category of applicant and leave the AO code field blank.

If a no-income individual is required to file income tax returns in the future due to a change in their income status, they will need to obtain the appropriate AO code from their local Income Tax Department office. What is AO code for a student who is applying for PAN card but does not have any source of income?