aeps id lene se pahale yah bhi jaan lete hai ki aeps kya hai yah kaise kaam karata hai – Aadhaar Enabled Payment System (AEPS) yah system National Payments Corporation of India ke dwara provide kiya jata hai companies ko fir vah chhote chhote shop owner ko provide karate hai ek retailer ke roop me.

yah aeps service National Payments Corporation of India ke rules ke according kaam karata hai.

AEPS Se Kya kya kaam hota hai ?

AEPS Service lene ke baad aap kisi bhi customer jisaka aadhar card usake bank account se link hai uske bank ka balance check karna, mini statement check karna ya balance withdrawal karna work hota hai. Isako anjam dene ke liye customer ka aadhar card number sath hi customer ka fingerprint dena hota hai sath hi kis bank se aap check ya balance nikalana chahate hai vah select karna hota hai, usake baad hi aeps service kaam karata hai.

Balance check – Isame apako bank account me total kitana balance hai vah bataya jata hai.

Mini Statement – isame apako bank account ki history bataya jata hai konasa amount kab bank account me receive huaa hai aur konasa amount kab account se nikala gaya hai.

Cash Withdrawal – Isase aap aadhar card number and finger laga ke aap bank account se paisa nikaal sakate hai. vah paisa aeps wallet me realtime aa jata hai fir agent apane bank account me Settlement Laga sakata hai vah paisa agent ke bank account me chal jayega.

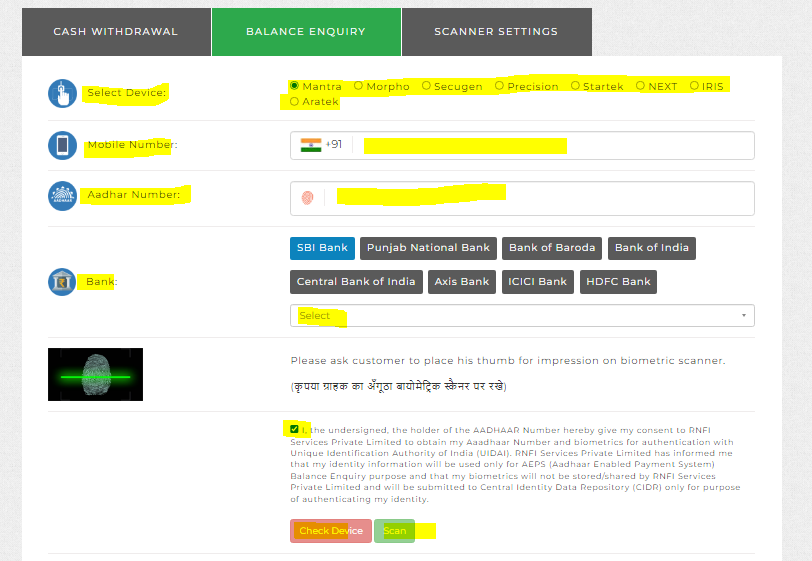

Aeps Balance Enquiry Kaise Kare ?

JAB Aap RNFI Portal Ko Login Karane ke baad AEPS Option me Balance Enquiry Button per click karate hai to apake samne aisa dekhne ko mil jata hai.

RNFI AEPS Support Device – Yaha se aap Mantra Morpho Secugen Precision Startek NEXT IRIS Aratek etc device support karata hai.

Mobile Number – Yaha per koi bhi phone number de sakate hai.

Aadhar Number – Yaha per customer ka 12 digit aadhar number enter karna hoga.

Bank Select – Aap jis bank se check karna chahate hai vah bank ka name select karna hai.

Check Device – Fir apako check device per click karna hai yah check karega ki apaka biometric device system se connect hai ya nahi.

Scan – fir apako successfully message milane ke baad apako Scan button per click kar dena hai. device me light jal jaeyga

Fir apko total balance bata diya jaeyga kitana balance hai.

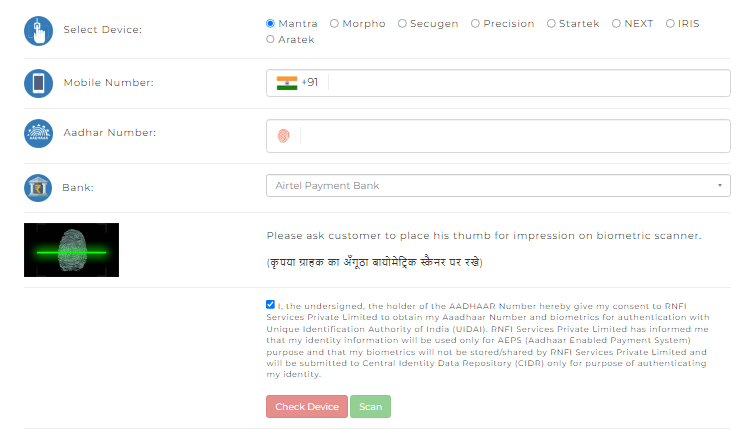

Aeps Mini Statement Kaise Kare ?

JAB Aap RNFI Portal Ko Login Karane ke baad AEPS Option me Aeps Mini Statement Button per click karate hai to apake samne aisa dekhne ko mil jata hai.

RNFI AEPS Support Device – Yaha se aap Mantra Morpho Secugen Precision Startek NEXT IRIS Aratek etc device support karata hai.

Mobile Number – Yaha per koi bhi phone number de sakate hai.

Aadhar Number – Yaha per customer ka 12 digit aadhar number enter karna hoga.

Bank Select – Aap jis bank se check karna chahate hai vah bank ka name select karna hai.

Check Device – Fir apako check device per click karna hai yah check karega ki apaka biometric device system se connect hai ya nahi.

Scan – fir apako successfully message milane ke baad apako Scan button per click kar dena hai. device me light jal jaeyga

Fir apko total balance bata diya jaeyga sath hi apako kuchh amount ka history bhi dekhane ko mil jata hai.

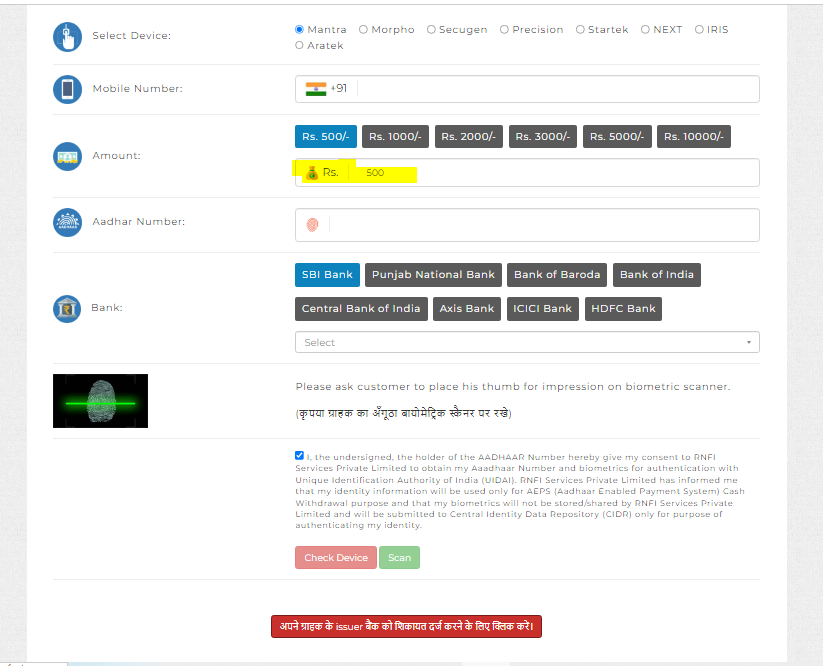

Aeps Cash Withdrawal Kaise Kare ?

JAB Aap RNFI Portal Ko Login Karane ke baad AEPS Option me Aeps Cash Withdrawal Button per click karate hai to apake samne aisa dekhne ko mil jata hai.

RNFI AEPS Support Device – Yaha se aap Mantra Morpho Secugen Precision Startek NEXT IRIS Aratek etc device support karata hai.

Mobile Number – Yaha per koi bhi phone number de sakate hai.

Amount – Yaha per aap amount select bhi kar sakate hai ya fir aap enter bhi kar sakate hai.

Aadhar Number – Yaha per customer ka 12 digit aadhar number enter karna hoga.

Bank Select – Aap jis bank se check karna chahate hai vah bank ka name select karna hai.

Check Device – Fir apako check device per click karna hai yah check karega ki apaka biometric device system se connect hai ya nahi.

Scan – fir apako successfully message milane ke baad apako Scan button per click kar dena hai. device me light jal jaeyga

Apake Samane Message aa jayega jisame likha aayega ki this bank se itana paisa nikal liya gaya hai ab isase bank account me itana balance bacha huaa hai.

AEPS ID Kaise Le

Agar aap aeps id lena chahate hai to aap contact this contact button per click kar sakate hai. apake samne chat option aa jayega.

Aap contact button per click kar ke aap aeps id banwa sakate hai. isake liye apko 99 rupees ka charge pay karna hoga. aeps id lene ke liye apako aadhar, pan card, bank passbook,emali id, mobile number ki jarurat hogi.

jaise aap contact this contact button per click kar ke chatting karate hai to apako turant mil jayega. aur aap kuchh hour me aeps id active karwa sakate hai. fir aap aeps service ka istemal kar sakate hai.

https://play.google.com/store/apps/details?id=com.services.relipay